maine excise tax exemption

BOAT EXCISE TAX EXEMPTION. It must be accompanied by a copy of the purchasers Certificate of Exemption issued by Maine Revenue Services valid at the time of sale.

_____ Home of Record legal address claimed for tax purposes.

. 434 20 is repealed. Board of Appeals Ordinance. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Pay property taxes online. ACTIVE DUTY STATIONED IN MAINE EXCISE TAX EXEMPTION Name. 2021 Commitment by name.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. The following are exempt from the excise tax. Comprehensive Plan Revised 2005.

207-626-4471 Homeless Veteran Coordination Team 207-287-7019 Maine Veterans Memorial Cemetery System 207-287-3481. BOAT EXISE TAX EXEMPTION. 429 2021 effective July 1 2022 with modifications to the applicable rates of tax and other provisions related to those taxes.

Excise Tax is an annual tax that must be paid prior to registering your vehicleExcept for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject. In 2019 Maine passed bill LD 1430 which introduces a solar tax exemption for both business and residential owners enabling renewable energy adopters to save moneywhile adding real value to their property and assets. The excise tax on a stock race car is 5.

Several examples of exemptions to the sales tax are most grocery products certain types of prescription medication some medical equipment and certain items which are associated with commerce. The Maine State Statutes regarding excise tax can be found in Title 36 Section 1482. The minimum tax is 5 for a motor vehicle other than a bicycle with motor attached 250 for a bicycle with motor attached 15 for a camper trailer other than a tent trailer and 5 for a tent trailer.

434 20 AMD 2. To be exempt under this subsection a vehicle must be used solely for the institutions purposes and primarily for transporting or delivering tangible goods to persons who have been determined to be eligible to receive charitable services from the institution. 2021 Tax commitment information.

The Superfund chemical excise taxes previously expired on December 31 1995. 692021 - PASSED TO BE ENACTED. HOMEPAGE Property Tax Division 51 Commerce Drive PO Box 9106 Augusta Maine 04332-9106 Phone 207 624-5600.

SummaryThis bill provides a motor vehicle excise tax exemption for veterans who are receiving benefits based on 100 permanent service-connected disability. PLEASE NOTE The State of Maine Property Tax Division only provides quotes to the Municipal Excise Tax Collector and not to individuals. 36 MRSA 1483 sub-8 as amended by PL 2009 c.

Contact 207283-3303 with any questions regarding the excise tax calculator. The seller must retain an Affidavit and a copy of the exemption card held by each person to whom exempt sales are made. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle.

As of August 2014 mil rates are as follows. Adult Use Marijuana Licensing Ordinance. Sponsored by Representative Heidi Brooks.

LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. Property Tax Maps and Information. Publications and Exemption Applications.

Board of Assessment Review Ordinance. Shoreland Zoning supplemental application. Veterans Excise Tax Exemption.

Excise Tax is an annual tax that must be paid when you are registering a vehicle. Maine Department of Inland Fisheries and Wildlife 353 Water Street 41 SHS Augusta ME 04333 Phone 207-287-8000 Fax 207-287-9037. The following shall be exempt from the tax imposed by this section.

Lifeboats or life rafts customarily carried or required to be carried by a watercraft for purposes of rescuing the occupants of the watercraft in case of danger. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days. To apply for the exemption the resident must provide.

The excise tax due will be 61080. MAINE DEPARTMENT OF INLAND FISHERIES AND WILDLIFE 284 State Street 41 SHS Augusta ME 04333 Phone 207-287-8000 Fax 207-287-8094. As our experience in Massachusetts has shown eligible businesses should take advantage of these types of laws as you can.

Each of these tax exemptions were classified by the GOC in consultation with the Taxation Committee under the policy area described as Interstate and Foreign Commerce. An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax Be it enacted by the People of the State of Maine as follows. A separate Affidavit or copy of the exemption card is not required.

This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle. They were reinstated by section 80201c3 of the Infrastructure Investment and Jobs Act Public Law 117-58 135 Stat. The 13 tax expenditures selected by the Committees for expedited review in 2020 include exemptions from the sales and use tax and exemptions from the fuel excise taxes.

Maine Bureau of Veterans Services Central Office 117 State House Station Augusta ME 04333-0117. Vehicles owned by this State or by political subdivisions of the State. Exempt under 36 MRSA.

Sales Tax Exemptions in Maine In Maine certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 2021 Commitment by maplot.

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

Pin On Goods And Service Tax Gst

Payroll Services Its Features Income Tax Return Income Tax Tax Deductions

Pin On Packaging Chocolate Turron

Pin On Goods And Service Tax Gst

Image Result For Gst Format Delivery Challan Invoicing Debit Goods And Services

Pin En Born In Blood Mafia Chronicles Cora Reilly

Benefits Of Gst Tax Advocate India Prevention Advocate 10 Things

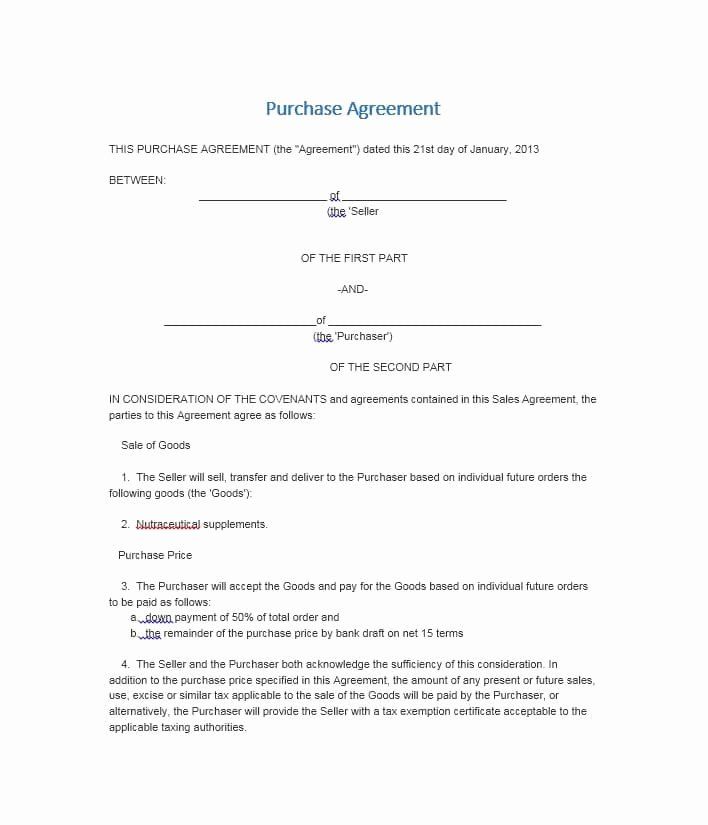

Pin On Letter Of Agreement Sample

Accounting Taxation Interest Rates Of Delay In I T Returns Submission I T Returns Non Submission Failure To Income Tax Return Interest Rates Pay Advance

Download Gst Tran 2 Return Excel Template Exceldatapro Excel Templates Excel Templates